This article is written by

. This article provides the readers with an in-depth analysis of the U.P Shops and Establishment Act,1962. It gives an overview of the purpose and objective behind the enactment of the Act. Further, it gives a detailed explanation of the important definitions of the Act, followed by an overview of the important provisions. The article also discusses the important judicial pronouncements relating to this Act.

It has been published by Rachit Garg.

This Act is also known as the U.P. Dookan Aur Vanijya Adhishthan Adhiniyam, or and the Legislative Council of U.P. passed it in Hindi on December 25, 1962. Furthermore, it was listed in the Uttar Pradesh Gazette after receiving the assent of the President on 18 December 1962. This Act certainly applies to all the shops and establishments operating in the state of Uttar Pradesh to be in compliance with the rules under this Act for the management of shops and commercial establishments, which can be further understood in this article.

The purpose and objectives of this Act regarding shops and establishments may vary across diverse states; however, usually, the fundamental objectives are similar. There may be some differences in the purposes and objectives of the Act as articulated in different statutes. Let’s understand the purpose and objectives of the Act:

There are several definitions described under Section 2 of the UP Shops and Establishment Act. Let’s discuss the important ones below:

Section 2(4) defines “Commercial Establishment” as the premise of a shop or factory in which any trade, business, or manufacturing is taking place and the profits are earned directly and indirectly from these activities, including the printing and journalist’s work as well. The establishment that deals with “insurance, banking, shares, stocks, and brokerage will also be referred to as a commercial establishment. Further including cinemas, theatres, and other places of entertainment and public amusement” will also fall under this definition.

Section 2(6) talks about “Employee” as a person who is employed wholly on wages by the employer in relation to any trade, business or manufacturing as carried in a shop or commercial establishment which includes the following-

Section 2(7) defines “Employer” as the person who has the charge or holds and has the ultimate control over the trade, business or manufacture that is carried in a shop or commercial establishment and also includes the manager with an agent or any other person who is under the control of the employer for the managing and control of such trade.

Section 2(8) complies with the meaning of the Factories Act of 1948, which certainly does not include the premise of factory or clerical work or those upon which the provisions of that Act do not apply.

Section 2 (16) defines “Shop” as referring to the premises of any trade retail or wholesale business taking place and the customers enjoying the services, including the warehouses, offices of business and godowns.

Section 2 (18) talks about wages as the remunerations by salary or allowances in the terms of money only payable by fulfilling the objectives of employment, express or implied, will be payable to the employee including the bonuses, the sums upon termination, remuneration for employment and any other additional sums for employment.

The whole Act would stand as a necessity for the proper means of setting up business or trade in the state of Uttar Pradesh, but there are provisions that are to be followed for easy business workflow. Below are the necessary provisions to be kept in mind in The U.P Shops and Establishment Act 1962:

Provisions of this Act do not apply to:

The notification shall be made by the state government in the interest of the public to exempt the subjects of shops or commercial establishments under the provisions of this Act.

It is the sole responsibility of the inspector for the maintenance of such records, which include a register of all the shops and commercial establishments that are registered under this Act.

Provided that different such registers may be maintained for different areas and for different classes of shops and commercial establishments.

The certificate granted under the previous Section will be liable for renewal of the certificate of registration from time to time as prescribed by the Chief Inspector. If the registration certificate is “lost, destroyed, torn, or is defaced or otherwise becomes illegible”, the Chief Inspector shall, to proceed only after the payment of the prescribed fee, issue a duplicate registration certificate.

Provided, if the employee not being a young person or a child shall be allowed to work more than the prescribed limit the total number of working hours including overtime should not exceed ten on any day only except on the day of stock-taking or the making of accounts.

Further, it is provided that the total working hours of overtime shall not be more than fifty in any quarter.

“Quarter” refers to the period of three consecutive months starting from the 1st of January, 1st of April, 1st of July or 1st of October

2. Any employee who has worked for more than the hours prescribed under clause(c) of sub-section(1) is to be paid by the employer for wages that are twice the ordinary rate including every overtime work.

“Ordinary rate” refers to the basic wages including the allowance, the cash that is equivalent to the advantage of the concessional sale of food grains and other items for the employee as the employee is entitled to, not including the bonus.

The calculation for the wages that are payable to the employee for the overtime work for a day is to be considered as eight working hours.

The working hours for the shops and commercial establishments shall be arranged in a manner in which the employee gets an interval for a minimum of half an hour after five hours of work and this period of work and intervals including the rest of the employees shall not be more than twelve hours a day.

Provided that the State Government keeping the interest of the public may alter such conditions as required generally for the different classes of shops and commercial establishments.

This part defines the powers of an inspector to enter all those shops and commercial establishments to examine the functions, check up registers and other related documents. The inspector can also accompany such a person for assistance with these works with the same powers as directed by the inspector and can also cease articles that are not in compliance with this Act.

The mandatory obligation of the employer of a shop or commercial establishment is to maintain registers and records of work and to display the required notices.

The court shall take cognizance of any offence made under this Act, except only on the complaint that is made in writing within six months of the date on which the offence is alleged to have been committed. Any other court, not inferior to that of a Magistrate of the Second Class, shall have the authority to try any offence under this Act or the rules made thereunder.

The provisions of the Workmen’s Compensation Act, 1923 including the rules made under shall be mutatis mutandis be applicable to every employee of a shop or the commercial establishment.

In this , a suit was filed by Anwar Khan and expired, as his legal representatives are the present respondents. The suit was filed as per the agreement between the field officer and the LIC, whose age of retirement is 60 years, and further appeals made by LIC were dismissed. The second appeal was filed before the HC and is said to be pending. In the meantime, Anwar Khan assisted the authorities under the , claiming compensation. LIC stated that the Development Officers are not covered under the act as they receive Rs. 1,000/- p.m. Later on, it was declared by the Assistant Labour Commissioner that the claimant was entitled to double compensation. Further modifications were made to the award as the claimant was entitled to the wages with compensation, and a writ petition was filed questioning the validity of the order passed by the appellate authority.

The validity of the decision passed by the appellant-LIC of India, for fixing the age of retirement of the Development Officer, now called Field Officer, at 58 years.

The petition was dismissed by the learned single judge, who held that the “Letter Patent Appeal” is not maintainable. As mentioned above, Anwar Khan passed away in 1990. The authorities standing before the HC under the Act must not have decided the claim that was made because it was for the declaration, and further, no relief was granted. The Act is said to have no application, as a result of which the compensation is not payable.

In this , the workman was a servant, as provided by the company to their officers at the petitioner’s residence, and would take leave only on Sundays. Later on, he was sued by the employer for taking holidays as misconduct. But the question was whether the servant was entitled to take a holiday. There were several questions about the validity of that servant as an employee of the company. It was highlighted in the later part that he was not considered an employee under Section 9, under which the employer allows the employee to take one whole day as a holiday in a week, and the absence of a servant on Sundays amounted to misconduct.

The question was whether the termination of the services of a servant is valid and whether the servant is entitled to leave upon one’s decision.

It was held in this case that this Act does not give an absolute right to the workmen to select the day for a holiday, as the employer has the sole right and has the choice to declare a holiday under of this Act. The servant was entitled to take a holiday on Sundays and if the employer did not allow it, then he/she would be violating the provisions of Section 9 of this Act, and the workman would be further entitled to the remedy. But it was on the part of the employer to give a holiday, and the servant took leave without the authorisation of the employer. It was held that the misconduct was made on three charges, of which one was upheld and the other had again gone back to labour court.

Anyone who lives in Uttar Pradesh and wants to set up a business shall require a licence. The setting up of a shop or establishment should be done within compliance with this Act and now it has become easier than before as the registration of any shop and commercial establishment can be done online by simply following the methods at the available for online registration and getting a license:

The table below will give you an idea of the required fee structure for the no of employees for the process of registration:

The U.P Dookan Aur Vanijya Adhishthan Adhiniyam, or Uttar Pradesh Shops and Establishments Act, is the primary legislation that provides a safeguard for all the shops and establishments in the State of Uttar Pradesh. The Act plays a very vital role in giving a valid registration and the benefits, including legal safeguards to both the employer and the employee, that can be availed of if the shop or the commercial establishment is registered under this Act.

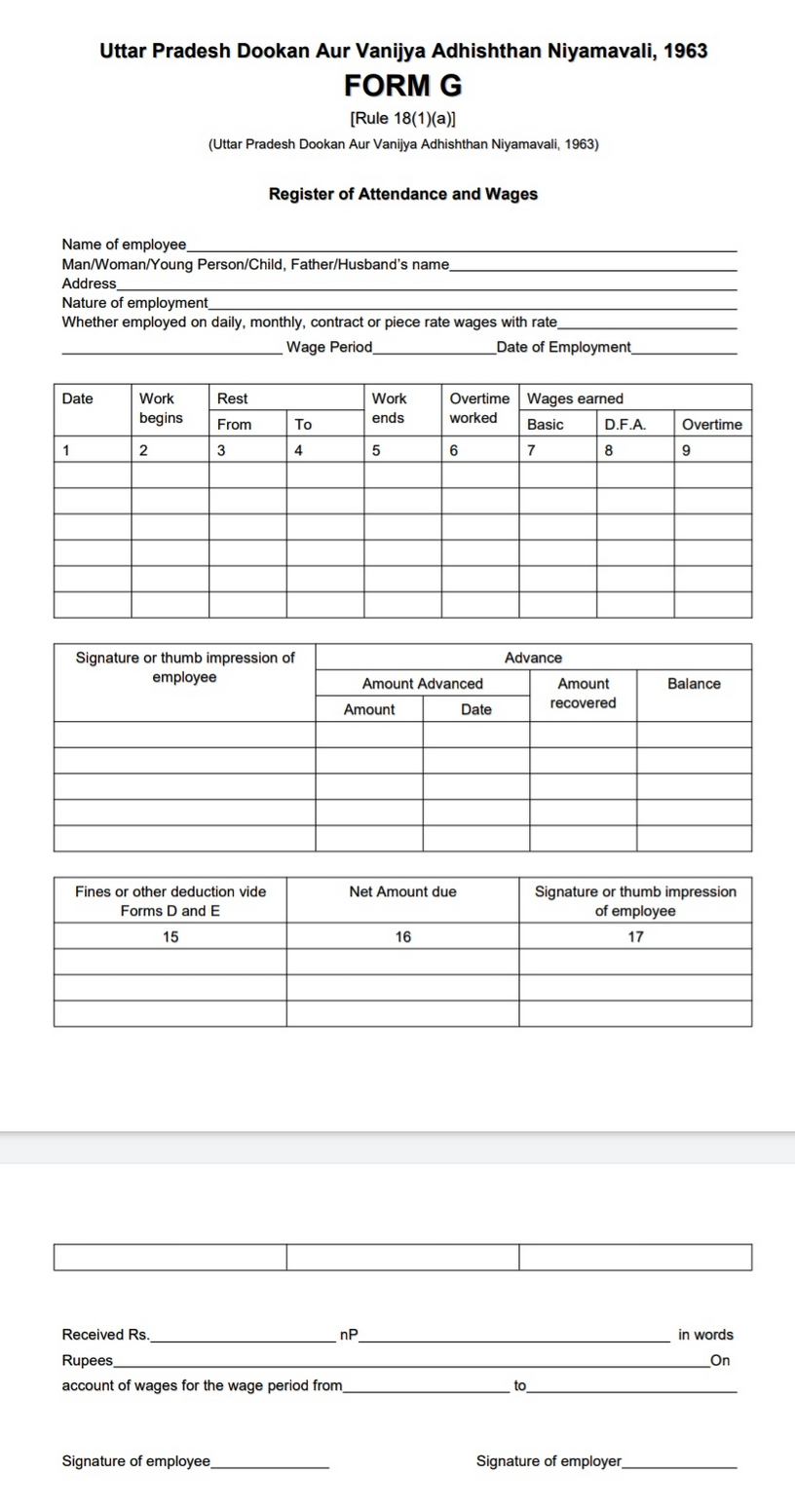

The establishment which consists of less than 10 workers must mandatorily submit an online intimation of commencement of the business and attach all required documents. Only after receiving this information along with all the required shall a receipt of Form ‘G’ be issued to the applicant online.

The Act consists of provisions in relation to “the payment of wages, terms of services, work hours, rest intervals, overtime work, opening and closing hours, closed days, holidays, leaves, maternity leave and benefits, work conditions, rules for employment of children, records maintenance, etc”.

To get a shop registered under the UP Shops and Establishment Act,1962 the following procedure needs to be followed by an applicant: First of all, open the given web address ( ). The website of the Uttar Pradesh Labor Department will open. Now click on the “Online Registration and Renewal” link.

Students of regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skills.

LawSikho has created a telegram group for exchanging legal knowledge, referrals, and various opportunities. You can click on this link and join:

Follow us on and subscribe to our channel for more amazing legal content.

The post appeared first on .

It has been published by Rachit Garg.

Introduction

This Act is also known as the U.P. Dookan Aur Vanijya Adhishthan Adhiniyam, or and the Legislative Council of U.P. passed it in Hindi on December 25, 1962. Furthermore, it was listed in the Uttar Pradesh Gazette after receiving the assent of the President on 18 December 1962. This Act certainly applies to all the shops and establishments operating in the state of Uttar Pradesh to be in compliance with the rules under this Act for the management of shops and commercial establishments, which can be further understood in this article.

Purpose and objectives of Uttar Pradesh Shops and Establishment Act, 1962

The purpose and objectives of this Act regarding shops and establishments may vary across diverse states; however, usually, the fundamental objectives are similar. There may be some differences in the purposes and objectives of the Act as articulated in different statutes. Let’s understand the purpose and objectives of the Act:

- Maintenance of work records

- Regulations for the employment of children and women

- Significant working conditions

- Providing maternity leaves and benefits

- Prescribe the functioning of the shop concerning the opening and closing hours of shops and commercial establishments

- Business hours with hours of work and overtime work

- Essential terms and conditions of service

- To provide intervals for rest

- Wages, including salary, bonus, and allowances to be paid

- Shops and commercial establishments are to be registered

- Appointment to be made of the Inspector, Chief Inspector, and Deputy Chief Inspector and delegating powers

Important definitions

There are several definitions described under Section 2 of the UP Shops and Establishment Act. Let’s discuss the important ones below:

Commercial Establishment

Section 2(4) defines “Commercial Establishment” as the premise of a shop or factory in which any trade, business, or manufacturing is taking place and the profits are earned directly and indirectly from these activities, including the printing and journalist’s work as well. The establishment that deals with “insurance, banking, shares, stocks, and brokerage will also be referred to as a commercial establishment. Further including cinemas, theatres, and other places of entertainment and public amusement” will also fall under this definition.

Employee

Section 2(6) talks about “Employee” as a person who is employed wholly on wages by the employer in relation to any trade, business or manufacturing as carried in a shop or commercial establishment which includes the following-

- Ward staff, the member of the watch or mali, and the caretaker.

- Any other staff or the clerk of the industrial establishment, not covered under the provisions of the Factories Act, 1948.

- A craft or apprentice or piece-rate worker.

Employer

Section 2(7) defines “Employer” as the person who has the charge or holds and has the ultimate control over the trade, business or manufacture that is carried in a shop or commercial establishment and also includes the manager with an agent or any other person who is under the control of the employer for the managing and control of such trade.

Factory

Section 2(8) complies with the meaning of the Factories Act of 1948, which certainly does not include the premise of factory or clerical work or those upon which the provisions of that Act do not apply.

Shop

Section 2 (16) defines “Shop” as referring to the premises of any trade retail or wholesale business taking place and the customers enjoying the services, including the warehouses, offices of business and godowns.

Wages

Section 2 (18) talks about wages as the remunerations by salary or allowances in the terms of money only payable by fulfilling the objectives of employment, express or implied, will be payable to the employee including the bonuses, the sums upon termination, remuneration for employment and any other additional sums for employment.

Essential Provisions of Uttar Pradesh Shops and Establishment Act, 1962

The whole Act would stand as a necessity for the proper means of setting up business or trade in the state of Uttar Pradesh, but there are provisions that are to be followed for easy business workflow. Below are the necessary provisions to be kept in mind in The U.P Shops and Establishment Act 1962:

Section 3 (The provisions of the Act not to apply to certain persons, shops and commercial establishments)

Provisions of this Act do not apply to:

- The employees who are appointed for confidential, managerial or supervisory work in any shop or commercial establishment, which include five employees and the employees exempted from the shop or commercial establishment shall not exceed more than ten per cent of the total employed persons.

- Employees who are associated with an intermittent type of work like a traveller or canvasser.

- Government or office of the local authorities.

- Authority or offices of the RBI.

- Establishment for the treatment or care of the sick infirm, destitute or mentally unfit.

- Employers’ family members.

The notification shall be made by the state government in the interest of the public to exempt the subjects of shops or commercial establishments under the provisions of this Act.

Section 4 (A) (Registration of shops and commercial establishment)

It is the sole responsibility of the inspector for the maintenance of such records, which include a register of all the shops and commercial establishments that are registered under this Act.

Provided that different such registers may be maintained for different areas and for different classes of shops and commercial establishments.

Section 4 (B) (Registration)

- The owner of the shop or the commercial establishment should apply to the Chief Inspector for the registration of the shop or commercial establishment within three months of the commencement of the business or three months of the commencement of the Uttar Pradesh Dookan Aur Vanijya Adhisthan (Sansodhan) Adhiniyam as prescribed which is later, apply to the Chief Inspector for registration of his shop or commercial establishment.

- Every application for registration under sub-section (1) shall be in such form and shall be accompanied by such fees as may be prescribed.

- Upon the satisfaction of the Chief Inspector upon receiving the amount of fee, the shop or commercial establishment is to be registered and regulated under Section 4-A, and shall also issue a certificate of registration to the owner in the manner prescribed.

Section 4 (C) and (D) (Term and Renewal of Registration Certificate/ Duplicate Registration Certificate)

The certificate granted under the previous Section will be liable for renewal of the certificate of registration from time to time as prescribed by the Chief Inspector. If the registration certificate is “lost, destroyed, torn, or is defaced or otherwise becomes illegible”, the Chief Inspector shall, to proceed only after the payment of the prescribed fee, issue a duplicate registration certificate.

Section 5 (Hours of business)

- The shops or commercial establishments not being a shop or commercial establishments mentioned in Schedule II shall not open earlier or close later than the period prescribed during registration.

- Regarding Sub-Section (1), the hours for the closing and opening of the shops or commercial establishments are to be prescribed for various areas.

- Notification shall be made in the official gazette by the state government to add or remove any class of shop or commercial establishment under Schedule II of this Act.

Section 6 (Hours of Work and Overtime)

- The employer shall not allow any employee to work on any day for more than-

- Five hours as a child.

- Six hours for a young person.

- Eight hours for any employee.

Provided, if the employee not being a young person or a child shall be allowed to work more than the prescribed limit the total number of working hours including overtime should not exceed ten on any day only except on the day of stock-taking or the making of accounts.

Further, it is provided that the total working hours of overtime shall not be more than fifty in any quarter.

“Quarter” refers to the period of three consecutive months starting from the 1st of January, 1st of April, 1st of July or 1st of October

2. Any employee who has worked for more than the hours prescribed under clause(c) of sub-section(1) is to be paid by the employer for wages that are twice the ordinary rate including every overtime work.

“Ordinary rate” refers to the basic wages including the allowance, the cash that is equivalent to the advantage of the concessional sale of food grains and other items for the employee as the employee is entitled to, not including the bonus.

The calculation for the wages that are payable to the employee for the overtime work for a day is to be considered as eight working hours.

Section 7 (Intervals for rest and spread-over of working hours in a day)

The working hours for the shops and commercial establishments shall be arranged in a manner in which the employee gets an interval for a minimum of half an hour after five hours of work and this period of work and intervals including the rest of the employees shall not be more than twelve hours a day.

Provided that the State Government keeping the interest of the public may alter such conditions as required generally for the different classes of shops and commercial establishments.

Section 8 (Close Days)

- The shop or commercial establishment not included in Schedule II is to be closed one day a week, and also on public holidays.

- The close day selected by the owner shall be subjected to approval from the authority that is appointed by the state. A notice highlighting the days of the holiday shall be displayed in the shop or commercial establishment.

- The days for a holiday or close days shall not be subjected to alteration more than once in a year, which would again require approval as per Sub-Section (2). The alteration will only take effect on the first day of January as:

- The close day does not match the prescribed day of the employer, which differs depending on the locality of the establishment, to be provided by the authority mentioned under Sub-Section (2) for a prescribed close day.

- The authority to declare only upon the suggestion made by the majority of the employers of that locality, after six months on which the close day was earlier fixed, shall alter the close day, which is not a public holiday.

Section 13 (Wage Period)

- The employer should fix a period certainly referred to as the wage period as of which the wages are to be payable to the employee.

- The wage period shall not exceed one month.

- The wages are only to be paid upon the said period as mentioned.

- The wages earned by him including the period of leave and the remuneration that is due to be paid-

- On the termination of his employment by or on behalf of the employer as before the expiry of the second working day for such termination.

- The termination of employment is made by the employee on or before the next payday.

Section 14 (Payment of wages for the period of earned leave)

- The employee who wants to proceed with earned leave shall be given an advance payment of wages towards the half period of leave, including the wage for the wage period preceding such leave. It shall be paid, including the wages for the remaining half period and the first day’s wages on the day of resuming duty.

- The period of sickness will include the wages that are to be paid to the employee on the first day of resuming duty.

Section 21 and 22 (Prohibition of employment of children and prohibition of employment of women and children during the night)

- Children shall not be required or allowed to work in any shop or commercial establishment but as apprentices, which is to be notified to the government through notification.

- Women and children shall not be required or allowed to work as employees during the night in any shop or commercial establishment.

Section 24 (Right of Absence during Pregnancy)

- A seven-day notice is required to be given by the pregnant woman employee to the employer for a period of leave not more than six weeks before the date of delivery.

- Upon receiving such notice, the employer approves being absent from duty for the prescribed period of six weeks before the date of delivery.

- The employer also has the responsibility upon receiving such notice, to require an examination to be conducted by a lady doctor at his cost, but if she desires or shall include any qualified medical practitioner.

- If the woman refuses to be the subject of such medical examination or is found not pregnant upon such examination, the child is not to be delivered within six weeks from the date of leave.

- The employer shall refuse to provide leave from duty if such a situation arises, or else the women employee is liable for relief from duty.

Section 30 (Power of inspector to enter)

This part defines the powers of an inspector to enter all those shops and commercial establishments to examine the functions, check up registers and other related documents. The inspector can also accompany such a person for assistance with these works with the same powers as directed by the inspector and can also cease articles that are not in compliance with this Act.

Section 32 (Maintenance of registers, and records by the employers)

The mandatory obligation of the employer of a shop or commercial establishment is to maintain registers and records of work and to display the required notices.

Section 36 (Limitation of prosecution, courts empowered to try offences under this Act)

The court shall take cognizance of any offence made under this Act, except only on the complaint that is made in writing within six months of the date on which the offence is alleged to have been committed. Any other court, not inferior to that of a Magistrate of the Second Class, shall have the authority to try any offence under this Act or the rules made thereunder.

Section 39 (Application of Workmen’s Compensation Act and Rules)

The provisions of the Workmen’s Compensation Act, 1923 including the rules made under shall be mutatis mutandis be applicable to every employee of a shop or the commercial establishment.

Landmark case laws

L.I.C of India v. Anwar Khan, (2007)

Facts

In this , a suit was filed by Anwar Khan and expired, as his legal representatives are the present respondents. The suit was filed as per the agreement between the field officer and the LIC, whose age of retirement is 60 years, and further appeals made by LIC were dismissed. The second appeal was filed before the HC and is said to be pending. In the meantime, Anwar Khan assisted the authorities under the , claiming compensation. LIC stated that the Development Officers are not covered under the act as they receive Rs. 1,000/- p.m. Later on, it was declared by the Assistant Labour Commissioner that the claimant was entitled to double compensation. Further modifications were made to the award as the claimant was entitled to the wages with compensation, and a writ petition was filed questioning the validity of the order passed by the appellate authority.

Issue

The validity of the decision passed by the appellant-LIC of India, for fixing the age of retirement of the Development Officer, now called Field Officer, at 58 years.

Judgement

The petition was dismissed by the learned single judge, who held that the “Letter Patent Appeal” is not maintainable. As mentioned above, Anwar Khan passed away in 1990. The authorities standing before the HC under the Act must not have decided the claim that was made because it was for the declaration, and further, no relief was granted. The Act is said to have no application, as a result of which the compensation is not payable.

Ganesh Floor Mills v. Labour Court (1970)

Facts

In this , the workman was a servant, as provided by the company to their officers at the petitioner’s residence, and would take leave only on Sundays. Later on, he was sued by the employer for taking holidays as misconduct. But the question was whether the servant was entitled to take a holiday. There were several questions about the validity of that servant as an employee of the company. It was highlighted in the later part that he was not considered an employee under Section 9, under which the employer allows the employee to take one whole day as a holiday in a week, and the absence of a servant on Sundays amounted to misconduct.

Issues

The question was whether the termination of the services of a servant is valid and whether the servant is entitled to leave upon one’s decision.

Judgement

It was held in this case that this Act does not give an absolute right to the workmen to select the day for a holiday, as the employer has the sole right and has the choice to declare a holiday under of this Act. The servant was entitled to take a holiday on Sundays and if the employer did not allow it, then he/she would be violating the provisions of Section 9 of this Act, and the workman would be further entitled to the remedy. But it was on the part of the employer to give a holiday, and the servant took leave without the authorisation of the employer. It was held that the misconduct was made on three charges, of which one was upheld and the other had again gone back to labour court.

Recent developments

Anyone who lives in Uttar Pradesh and wants to set up a business shall require a licence. The setting up of a shop or establishment should be done within compliance with this Act and now it has become easier than before as the registration of any shop and commercial establishment can be done online by simply following the methods at the available for online registration and getting a license:

- As entering the site of the labour department of Uttar Pradesh government. A profile is needed to be created by the owner of the business and fill all the necessary details that are required.

- Certain documents are required to be uploaded for the completion of the registration process.

- A further step would demand a prescribed amount of fee to complete the process.

- After the payment of the registration fees, the owner needs to provide the details of the challan, the date of the payment for the application form and the name of the bank.

- After the successful filing of the form for registration, it undergoes a review process by the labour enforcement officer for verification and giving validity to these details and then issues a licence for shops and establishments.

The table below will give you an idea of the required fee structure for the no of employees for the process of registration:

| No. of Employees | Price |

|---|---|

| 01-55-1011-2525+ | Rs 40Rs 200Rs 300Rs 500Rs 1000 |

Conclusion

The U.P Dookan Aur Vanijya Adhishthan Adhiniyam, or Uttar Pradesh Shops and Establishments Act, is the primary legislation that provides a safeguard for all the shops and establishments in the State of Uttar Pradesh. The Act plays a very vital role in giving a valid registration and the benefits, including legal safeguards to both the employer and the employee, that can be availed of if the shop or the commercial establishment is registered under this Act.

Frequently Asked Questions (FAQs)

Is shop and establishment licence compulsory for less than 10 employees in Uttar Pradesh?

The establishment which consists of less than 10 workers must mandatorily submit an online intimation of commencement of the business and attach all required documents. Only after receiving this information along with all the required shall a receipt of Form ‘G’ be issued to the applicant online.

What are the provisions of the UP Shops and Commercial Establishments Act?

The Act consists of provisions in relation to “the payment of wages, terms of services, work hours, rest intervals, overtime work, opening and closing hours, closed days, holidays, leaves, maternity leave and benefits, work conditions, rules for employment of children, records maintenance, etc”.

How do I register under the Shop and Establishment Act in UP?

To get a shop registered under the UP Shops and Establishment Act,1962 the following procedure needs to be followed by an applicant: First of all, open the given web address ( ). The website of the Uttar Pradesh Labor Department will open. Now click on the “Online Registration and Renewal” link.

References

Students of regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skills.

LawSikho has created a telegram group for exchanging legal knowledge, referrals, and various opportunities. You can click on this link and join:

Follow us on and subscribe to our channel for more amazing legal content.

The post appeared first on .